The unstable economic situation in Ukraine most often becomes the reason for emigration from the country. Another reason may be the desire to get a better education or work in a higher-paid position. Whatever the reason, immigration to Europe from Ukraine is a way to make your life better, and your income higher. Ukrainians choose other destinations too, for example, Canada and the United States. Nevertheless, the countries of Europe are closer to us. The reasons for choosing European countries are obvious:

- similar climate;

- high level of ecology;

- low crime rate;

- close location to Ukraine, which makes it possible to see relatives more often (sometimes the flight takes no more than 2 hours, and ticket prices in low-cost airlines contribute to such trips).

Immigration to Europe From Ukraine: The Main Ways

Although the political goals of the EU countries are common, often the legislation relating to residents is significantly different. You need to carefully study the requirements of each country. Still, there are a number of main ways to move for permanent residence:

- business immigration to Europe;

- labor immigration;

- family immigration to Europe (mainly for family reunification);

- purchase of real estate;

- studying in European universities;

- long-term treatment;

- volunteering;

- financial investments.

What Country Is It Easier to Emigrate From Ukraine to Europe?

Each country has its conditions for emigrants. Naturally, it is easier to emigrate to a country that sets loyal conditions. Then you will need fewer documents and, accordingly, time for their processing. This includes Romania, Latvia, Spain, Greece, Lithuania, Hungary, and Portugal. There are many programs for attracting foreigners on preferential terms.

If moving to the EU for you is not about ease of registration, but about a high standard of living and income, then the list will be significantly different. In this aspect, we have also prepared a list of countries to choose from:

- Norway;

- Slovakia;

- Finland;

- Italy;

- Slovenia;

- France.

If Italy and France are more familiar destinations for Ukrainians, then the rest of the countries are mysteries for many of us. But they offer excellent conditions for moving. The reasons for moving are high-paying job, formal employment, and many countries offer immigration programs for refugees. Business immigration to Europe is also popular, especially in the era of prosperity of the IT-sphere. So, if we talk about a highly paid job, then the specialists from the field of medicine, science, IT, and engineering have the best chance of moving to Europe for permanent residence. In this aspect, it is better to choose the countries of Western Europe. If we are talking about working specialties, then it is better to choose Eastern Europe.

Legal Relocation to the EU Is a Reality Today

In the European Union, legal immigration is considered a proven measure to prevent the illegal influx of migrants. European Commission-appointed President Ursula von der Leyen has proposed reforming the EU refugee system to create more opportunities for legal migration. This is another chance to find a better-paying job and decide for yourself which is the best country in Europe for immigration. After all, everyone has different priorities and requirements.

Interesting Information for Immigrants

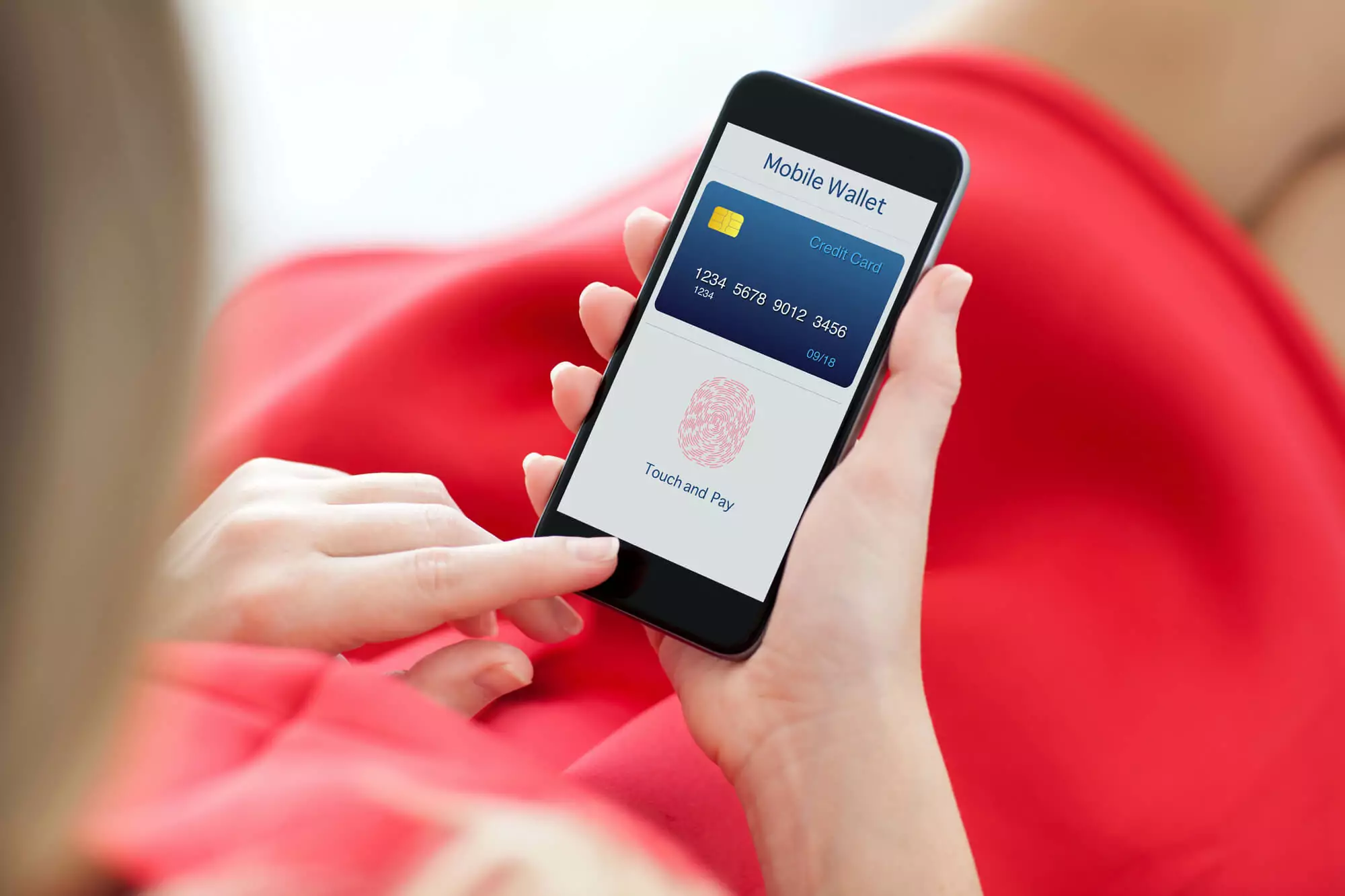

If you already live outside Ukraine, work, then, for sure, you are interested in how to financially support relatives and friends from Ukraine. Previously, the most popular ways to transfer money were bank transfers and the transfer of money by people returning to Ukraine. Today there is a more convenient, safer, and faster way – our service Perekaz24. Every day, using the service of instant transfers, people transfer money to Ukraine from Spain, Czech Republic, Great Britain, Slovakia, Poland, and other European countries. They leave only positive reviews, highlighting the following benefits:

- transaction speed;

- the possibility of cashless transfers from card to card;

- no requirement to provide documents;

- the first transfer is free and the minimum commission for the subsequent ones;

- round-the-clock work operation;

- the service is available in Ukrainian, Russian, English, and Polish.

The Perekaz24 service is a great solution if you regularly transfer small amounts. If, for example, you need to transfer money to your daughter to pay for education for a month, then this is a great option. Moreover, even if you need money instantly at night or on a weekend, then no doubt choose Perekaz24. It is enough to fill in the registration form once, the following transfers will take you one or two minutes. See for yourself how convenient everything is! More information can be found at https://perekaz24.eu/.